Clinton: Killed Glass-Steagall—Banks Gambled, Taxpayers Paid

Introduction to Glass-Steagall

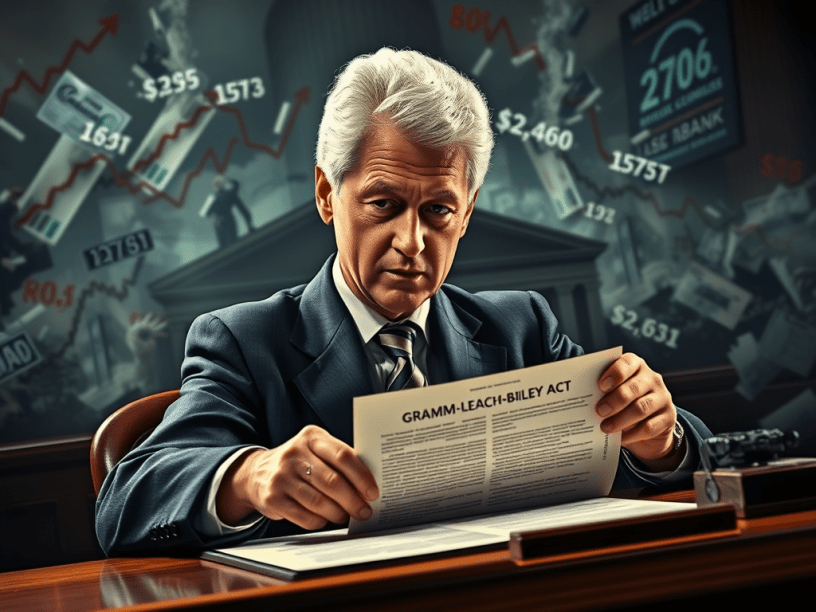

In the late 1990s, President Bill Clinton made a significant decision that would change the banking industry and impact American taxpayers for years to come. He signed the Gramm-Leach-Bliley Act of 1999, which effectively repealed the Glass-Steagall Act of 1933. This was an important piece of legislation that separated commercial banking, investment banking, and insurance services. By removing these barriers, Clinton opened the doors for banks to engage in riskier financial activities. As a result, banks began to gamble with the money of their clients, leading to a financial crisis that put taxpayers on the hook for the mistakes made by these institutions.

The Purpose of Glass-Steagall

To understand why this happened, we must first look at the Glass-Steagall Act. This law was created during the Great Depression to protect consumers and stabilize the banking system. It prevented banks from using customer deposits for risky investments. This separation was meant to keep the financial system safe and secure. However, by the 1990s, many believed the law was outdated. Financial services became more complex, and banks argued that they needed to adapt to compete globally. They pushed for changes, and Clinton listened.

The Risks of Repeal

The repeal of Glass-Steagall allowed banks to expand their operations. They could now offer a wider range of services, such as investment banking alongside traditional banking. This change encouraged banks to take on higher risks, believing they could make more profits. However, it also meant that taxpayers could face the consequences if these risks led to failures. As banks began to gamble with investments, they became less concerned about the potential fallout.

During this period, we saw a rise in high-risk mortgage-backed securities and other complex financial products. Banks sold these investments to investors, claiming they were safe and reliable. However, when the housing bubble burst in 2007, these investments lost value quickly, leading to massive losses for financial institutions. Many banks that had taken on too much risk faced bankruptcy. Unable to let major banks fail—since this would have hurt the economy—Congress and the government stepped in. They used taxpayer money to bail out these banks, arguing that the economy needed stability.

Triangulation and Political Strategy

Clinton’s actions were part of a broader strategy known as “triangulation.” This term refers to a political approach where leaders take ideas from both sides of the aisle to create compromise. By appealing to businesses and deregulating the banking industry, Clinton gained support from conservatives while still maintaining his base. However, this strategy left many Americans feeling betrayed. The very people who needed protection from risky banking practices were the ones who suffered when the economy crashed.

The Bailout and Its Consequences

As taxpayers, Americans had to bear the cost of these mistakes. The Troubled Asset Relief Program (TARP) was introduced in 2008 to stabilize the financial system. This program used $700 billion of taxpayer money to buy troubled assets from banks, ensuring they had enough liquidity to continue operations. While this helped prevent a complete economic collapse, many Americans felt frustrated. They saw their hard-earned money being used to rescue banks that had taken reckless risks.

Lasting Impact and Reflection

The consequences of repealing Glass-Steagall continue to resonate today. While some argue that deregulation was necessary for economic growth, others believe it led to greater inequality and instability. Many Americans recall the financial crisis and the struggles that followed, such as high unemployment rates, foreclosures, and lost savings. As the economy slowly recovered, the sense of injustice lingered.

Conclusion

In conclusion, President Clinton’s decision to repeal Glass-Steagall allowed banks to take on riskier investments, which ultimately led to a financial crisis that taxpayers had to pay for. The changes made in the 1990s had far-reaching effects, highlighting the dangers of deregulation in the financial sector. While Clinton’s triangulation strategy sought to create compromise, it left many Americans vulnerable to the consequences of risky banking practices. As we reflect on these events, it is essential to remember the lessons learned and consider the importance of regulating financial institutions to protect consumers and stabilize the economy.